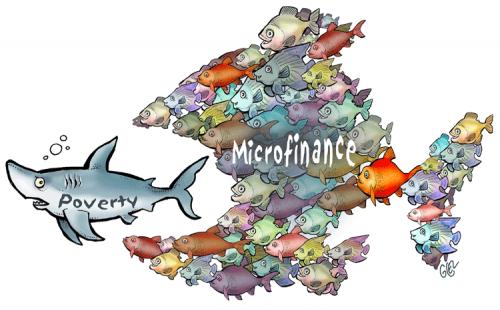

Microfinance – A Hype or An Effective Financial Tool For the Poor?

Is Microfinance an effective financial strategy to eradicate poverty particularly in developing economies?

I would blog on this as briefly and pragmatic as possible, as some of you may know that this topic is quite broad and would require empirical data/analysis to support any findings and recommendations.

In its simplest terms, microfinance involves extending loans to a group of borrowers or individuals, specifically the marginalized sector of society involving poor people encountering difficulties to transact business with private and government banking institutions. In other words, these are the poor people throughout the world numbering over 1 billion living in rural areas with less than $1.25 per day and who cannot afford to meet the collateral requirements offered by banks and other financing institutions. As such, these people cannot qualify for credit services which, in a way, could help improve their lives. Microfinance is also known as microcredit as lending transactions can go as low as $25.00 for a start-up business. Grameen Bank is one of the pioneers in microfinance operations.

Four years ago, I was contemplating on coming up with an impact study regarding microfinance activities in South East Asia, in conjunction with the plan to privatize the operational aspect of a particular government owned credit facility in my home country. The study would have likewise touched on how the money from donor countries, multilateral institutions and affluent private individuals were utilized for these kind of operations, specifically on whether or not the funds were properly utilized/monitored and that the funds indeed were catered to intended beneficiaries, the qualified poorest of the poor. However, the said plan was put on the back burner in view of the 180-degree turnaround in my career. While the said plan was set aside, it was not forgotten, these things were still part of the agenda and to-do-lists.

Incidentally, Microfinance is considered by the UN as important and an integral part of the efforts to achieve its Millennium Development Goals (MDG’s). You’ll observe that my blog has tackled earlier topics on the MDG’s and so the subject matter is still in line with my blog’s objectives.

Similarly, some of my closest relatives have recently participated in lending money to the poor.

They joined (as lenders) Kiva, an international non-government organization (NGO), the mission of which, among others, is to assist poor people access to safe and well-priced credit through its lenders and field partners. Said lenders are given the choice on which person or loan requests they would like to fund. As mentioned earlier, the minimum fund ceiling involves a measly amount, only $25.00 and the lenders can hopefully make a change in the life of a small borrower. Since it involves small amounts, the loan is non-interest bearing and the repayment schedule would depend on the borrower’s capacity to pay, thus there may be some risks attached to it. The primary objective here is not for the “haves” to gain interest from their investments, but the happiness that they gained from helping alleviate the lives of the poor. I was just happy to note of my relatives’ decision to join in this endeavor. A good deed to start for the New Year!

But as I said, does microfinance activities really benefit the qualified poorest of the poor? Does it really improve the quality of life of the poor? There are so many things being said in the media but how accurate are these? While there are positive contributions and advantages of microfinance activities throughout the world, there are calls for changes and reforms as there were findings and cases where there were anomalies and bad practices in certain NGO’s and non-profit organizations involved in this undertaking. One was a case of fund diversion and another was regarding allegations that some of the funds earmarked for qualified beneficiaries went to individuals who weren’t poor at all!

Likewise, there is also a need to look at the entrepreneurial skills of the borrower individuals as most of them may lack education about engaging in any form of business. I recall some small borrowers of a certain government financial institutions were not able to continue operating the business and not being able to pay the loans at the end of the day as they were not equipped with all the skills needed to be successful even in low level businesses. It turned out these borrowers faced various difficulties on the marketing aspect and other financial services such as insurance, etc. Apparently, the lending institutions merely approved loans without giving due attention to the other needs of the small borrowers, i.e. educating them about doing business, particularly products marketing.

Sure, there are visible positive effects but there are dangers of the so-called hype of microfinance. Yes, it may sound something smart and in-thing to do but there are things to look at before a particular developing economy ventures into this kind of endeavor. Perhaps a policy framework and implementing guidelines should be well crafted taking into account the best practices and the lessons learned from other countries which have previously dealt with it.

Should you however have the heart now and extra bucks to help those in need to improve their lives, go ahead and look for a reputable NGO who would be able to assist you on this matter. It would be good to conduct due diligence before embarking on any venture, especially if it involves large amounts. By the way, my relatives are now receving the monthly payments from their chosen borrower. Good job, borrower!

My next blog on microfinance is on how overseas contract workers and retirees can avail of said activity in their respective home countries.

…..At the end of the 1990s the success of microcredit allowed for the development of microfinance which includes a range of financial services intended for poor people Credit savings insurance and support………There is a growing securitization of microfinance which must be supervised and regulated so that microfinance remains a social tool for the development of poor populations… …..For the last few years there has been an increase in the number of regulations in the microfinance sector.

Roberta, thanks for your thoughts! Appreciate it.

I share the same view that a concrete and well crafted regulatory framework

and a workable pro-poor implementing guidelines should be in place so as to

address the pitfalls of certain activiites in the microfinance industry.

Ever since Muhammad Yunus and his Grameen Bank were awarded the Nobel Peace Prize in 2006 for their efforts to create economic and social development from below there has been a surge in world attention on microfinance and its power to fight poverty. Despite these achievements there is still a long way to go to fill the demand-supply gap especially in rural areas where delivering financial services presents particular challenges.

Thank you for your comments Diego (?)!

That is precisely the essence of this blog!

True, Grameen Bank-Bangladesh should be credited for such innovation as it pioneered and helped certain disadvantaged sectors of society undertake better opportunities and taste the good side of life.

As such, other developing countries and even tiger and industrialized economies have replicated microfinance or are currently contemplating to do it as a possible means to eradicate poverty in their respective homes.

That is also why this blog mentioned that there are certain areas for consideration to make this endeavor really work; e.g.lack of education and experience of the poor to understand and manage even low level business activities; the mind-set of people in rural areas, most of them are risk-averse; and transparency and strong commitment on the part of those who delivers and develops sustainable financial services to the poor, etc.

Sure, there are lots of things to be done and tough challenges to face to make this program a concrete solution to the world-wide problem on poverty!

Incidentally, what is “monex” got to do with microfinance? Are you one of the lenders? Just asking! 🙂

It’s all good, but I think the focus of organisations that facilitate financing shall be on revision of current models for microloans. They are hardly efficient. Just think, we have close to 3 billion people — and that’s close to half of the human population of the planet — who still live on less than $2 per day. Moreover, 2 thirds of them, which is 2 billion, remain absolutely “unbanked” – they do not have any access to traditional financial infrastructures. So the coverage of the alliances in the field must be much wider.

I quite agree with what you’ve articulated on the need to craft new models for microfinance related activities specifically in

poor countries, taking into account the best practices and lessons learned from concerned institutions and economies. We have yet to see financing entities and affluent individuals committed to share their technical know how and treasures to people throughout the world so as to uplift the quality of lives of those who are still living under the poverty line. To make this

work, a concerted effort from both the public and the private sectors is necessary, perhaps a regulatory body should be created to monitor the said activities, to make sure that the donated/loanable funds are catered to the poorest of the poor and that follow-up and exit mechanisms are in place.

Likeable article, very caring! You have the heart for the poor. Bless you man!

Thanks Rapa, I came from a humble family. Even now, I still maintain a simple lifestyle. Not because I don’t want to spend, but I have nothing extra to spend!

What a remarkable post! This is an opportunity for certain disadvantaged group in the society to express and show their skills and be productive. There are still benevolent people out there who are sincere to lend a part of their treasures for valuable cause. Thanks for your ideas on the subject.

Microfinance institutions has been there for quite a while serving the poorest of the poor. What surprises me is that we hardly see successful models on this except for few individuals and families throughout the world who have been able to level up their standards of living. Microfinance activities have not actually contributed much to a particular country’s economic growth in its entirety, probably there is if seen on a micro point of view. But this is not enough. I am no expert on this tho, I just hope these institutions would be more proactive in assisting the rural poor who are willing and able to avail these kind of activities. Each country has learned from its past mistakes, hence the need to formulate reforms on this matter to suit everyone’s requirements.